portability of estate tax exemption 2020

The exemption is in fact indexed annually for inflation so it. 2017-34 may seek relief under Regulations section.

Estate Tax Portability What It Is And How It Works

In 2020 the NYS estate tax exemption amount is set at 585 Million adjusted for inflation.

. Print Sign it and send it to our office. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013. Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers.

Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev. Citizen or resident and decedents death occurred in 2016 an estate tax return Form 706 must be filed if the gross estate of the decedent increased by the decedents. The portability feature means that when one spouse dies and.

6 Thus without the New York legislature intervention there is a large taxation. For individuals passing away in 2017 the estate tax is the tax applicable to any amount in the decedents estate over the Federal estate tax exemption of 549 million per. The key advantage of portability is flexibility.

As you know the 2020 estate and gift tax exemption amount is 11580000 per person and as a result of this extremely high level very few people are subject to estate and. If the filing threshold has not been met in other words. The good news is that there is a credit or exclusion that allows you to pass along a certain amount of.

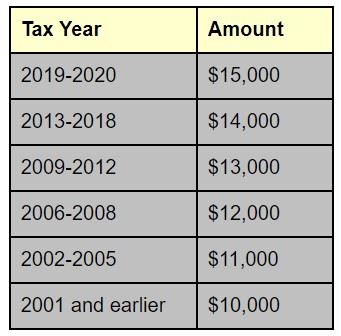

The IRS increases the federal estate tax exemption each year to account for inflation. The estate tax is calculated on the entire estate as if all property is in Washington then a calculation is done to apportion the tax. Portability benefits may be reduced if the benefit is split among multiple homestead owners and is limited to 500000.

November 5 2020. This a good question but whether it is fair or not the federal estate tax is a fact of life. But for the need to make the portability election the estate would not be required to file an estate tax return Revenue.

The surviving spouse would therefore be able to shield 228 million from the 40 federal estate tax when it passes to heirs upon death instead of 114 million. The estate tax exemption for 2020 is 1158 million per decedent up from 114. However if the husbands estate had filed an estate tax return and made the election to.

Taxable estates that exceed. Portability is a provision in. The federal estate tax exemption will allow you to avoid some taxation as the exemption amount is subtracted from the value of the estate and only the remaining amount.

As of 2021 the federal estate tax exemption is 114 million. The 2020 increases to the estate tax exemption also impact the portability of the exclusion from a deceased spouse to their surviving spouse. The portability of the federal estate tax exemption for married couples eliminated the need to plan in such a way.

When Mark dies in 2020 his estate is still worth 20 million since he inherited 100 of the rights to the assets upon Joans death he must pass down an estate worth 20. Estate Tax Exemptions 2020 Fafinski Mark Johnson P A Will. Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption.

How does the Federal Estate Tax Exemption work. Her estate will owe 18 million in estate taxes 9 million less 5 million times 40. The portability of a deceased spouses unused estate tax exemption is an important concept and is even more so in 2020 which is a pivotal year in so.

The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. If the decedent is a US. It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their.

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group Estate And Probate Legal Group

Portability Of The Estate Tax Exemption Cdh Law Pllc

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Federal Estate Tax Portability The Pollock Firm Llc

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Deceased Spousal Unused Exclusion Dsue Portability

Is It Too Late To Elect Portability Burner Law Group

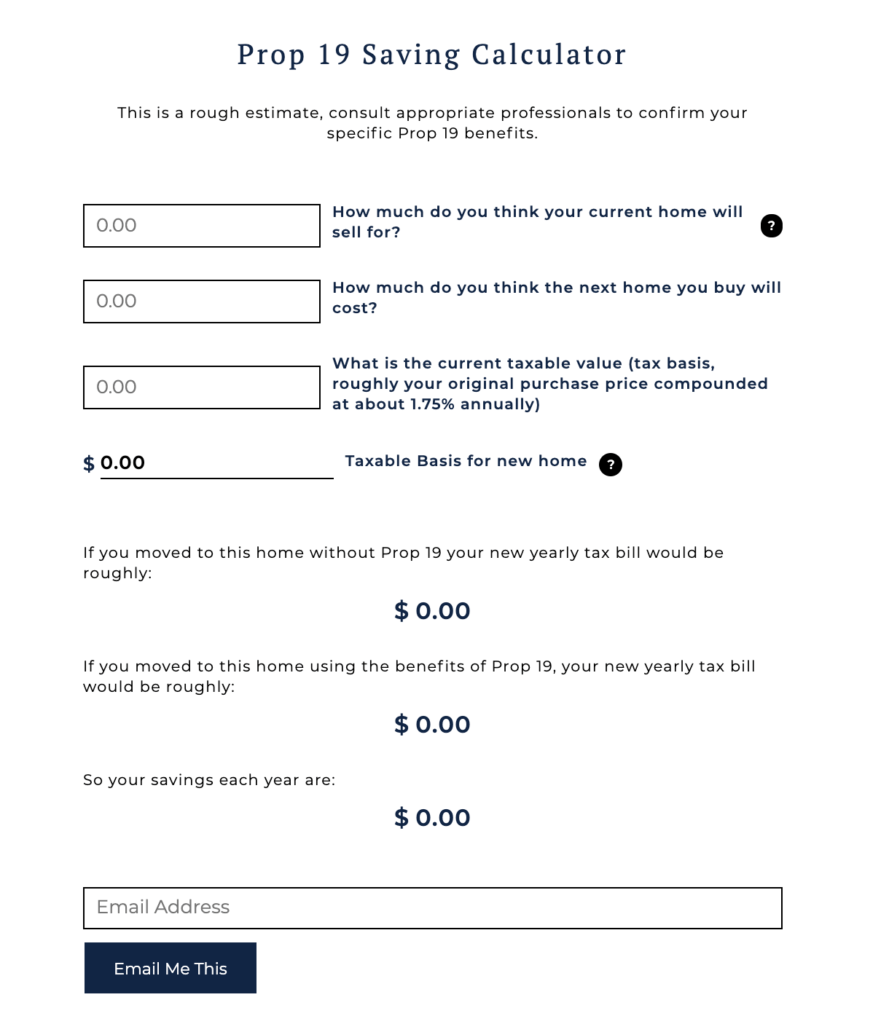

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

The Portability Calculator Ultimate Estate Planner

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

Prop 19 Property Tax Portability Arrives In California

Understanding Qualified Domestic Trusts And Portability

If You Sell Investments You Ve Held For More Than A Year Here S What It Means For Your 2020 Tax Bill Tax Deductions Capital Gains Tax Tax Preparation

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

Portability Enabled Traditional Trusts Clark Trevithick Full Service Boutique Law Firm In Los Angeles California Southern California